Review of Tom Bilyeu’s Impact Theory

Tom Bilyeu is a podcaster (Impact Theory). Made a fortune selling health bars, took up podcasting. He started out mainly interviewing authors and other influencers, focusing on pop business advice/entrepreneurship, self-actualization/success, and health/wellness. He interviews indiscriminately, both knowledgeable people about their area of expertise and cranks and health quacks. And trendy idea authors, which describes a lot of the business authors. In the last two years, he started talking about economics–inflation and government debt, inequality and taxes.

His podcast is pitched to people in top 20% – 5% of income. He tells them that government debt is causing inflation and this leads to rich to getting richer and the poor poorer. The solution is investment. He gives his upper-middle class listeners the idea that their interests are the same as the the interests as the billionaires and hundred-millionaires. Increased taxes won’t help, and it will make things worse. Cutting government regulation of all types is key to increasing investment and returns on investment. So basically business conservatism, with a dose of ‘debt will destroy the US’.

Tom Bilyeu is an intellectual light weight. Familiar with conventional wisdom, and practiced at spouting it. He plucks ideas from his guests, pop science, the Zeitgeist, and throws them in as analogies, examples, whether they fit or not, not really understanding them. He comes off as a dumb guy’s idea of smart, well-informed guy.

His recent big idea is that inflation causes inequality and people need to invest to build wealth. He mostly avoids connecting this to political parties, but is always pushing conservative ideas and avoids criticism of Republican actions and policy.

For example, current US federal debt is $36 trillion, and the recent Republican budget will increase it by an additional $4 trillion (over the pre-existing projected increase). But a scan of episodes when the budget was being passed doesn’t see it showing up as a topic. The first rule of holes is when you are in a hole stop digging, so this is an easy one.

Tom Bilyeu has a poor grasp of economics, but strong opinions. Thinks the flat tax is good idea. Says taxing wealth is basically impossible, impractical, and would have the effect of severely cutting investment.

Bilyeu bolsters his economic arguments with historical examples, China under Mao, Cambodia under the Khmer Rouge, the French Revolution of 1789-99. He doesn’t seem to know much American history, he’s never asked himself, how did the US go from high income and wealth inequality in the 1880s-1890s to a much lower level in 1960s-1970s?

July 28 episode

I listened to the July 28 episode, “The Death of the Middle Class: Tax the Rich or Fix the System” (titled “What You’ve Been Told About Taxes Is a Lie — Here’s Who Really Pays” on Youtube). It was very dishonest. Bilyeu uses real figures, but not the appropriate stats for the topic. Bilyeu tees up his argument by describing taxes paid by the rich and the poor, and for ‘taxes’ talks only about federal income taxes. Not all taxes (local + federal), not even all federal taxes–leaving out the 16.4% Social Security and 1.65% Medicare taxes, totaling 18% paid by all low/middle income workers. So he argues that most ‘taxes’ are paid by the rich, way in excess to their share of total income in the country. Total tax burden in the US is nearly flat–20% for the poorest quintile to 33% for the top 1%. And the rich have innovated tax avoidance–they get gains directly as wealth without it even showing up as income–they minimize income. Even estate taxes are bypassed. It is true that the rich pay much more in federal income tax than the poorer half of Americans. And this is because the poorer half don’t have much, and spend nearly all their income on food, shelter, medical care, and other essentials. You can’t get money from a stone. Also, the rich have been taking a larger percent of the total gains in the economy every year, raking in a bigger chunk of the total US income each year, so pay a larger portion of income taxes every year. The highest US tax burden is on the upper middle class and lower upper class, people making $250k-$1M, especially those whose income is reported to the feds as W-2 or 1099 income.

Inequality in the US is high and has increased in the last few decades. What can be done, according to Bilyeu? Taxes on the rich can’t be raised, that is unpossible, like dividing by zero. And even if it was done, it wouldn’t be fair (the rich pay way more than their fair share in taxes today). And it would decrease investment and therefore the growth of the economy so everyone would just be poorer, and the rich would just leave the country. Also, in support of his argument, he cites the crank economics Laffer curve. A bunch of nonsense arguments.

He also makes the creative argument that wealth is unknowable, unmeasurable, that taxing wealth would mean taxing unrealized gains, which are ineffable and they don’t exist until assets are sold and income is recorded. This is a surprise to banks, which routinely appraise these assets as collateral for loans. Liquid assets–traded stocks, bonds, etc. of course have a market price.

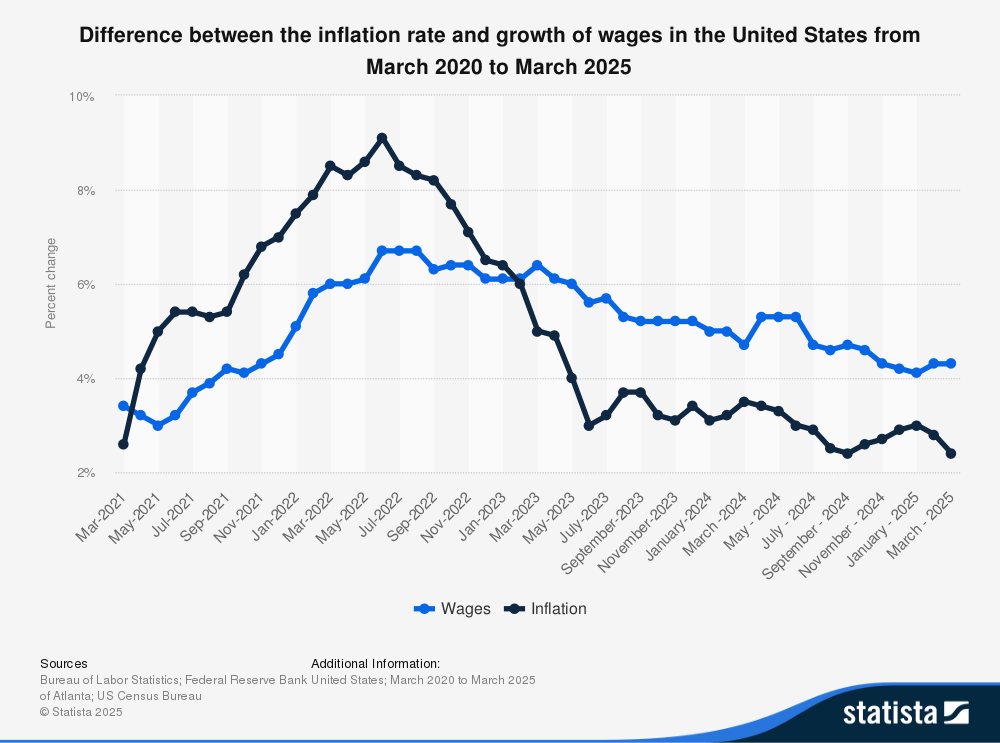

Bilyeu points to inflation (government printing money!) as eroding the wealth of the poor and increasing the price assets held by the rich. This isn’t right–the poor don’t have assets and the main asset of the middle class is the family home. And wages have kept up with inflation as the US went through the pandemic and post-pandemic inflation. Interestingly, the poorest workers have done better than middle income workers.

Bilyeu goes on to make laughable arguments about how the rich will leave if taxes go up. The rich using tax havens to avoid taxes (and legal/political difficulties) is a huge problem. Of course, the US is one of the those tax havens where looters stash their money, London is another one. Lots of unoccupied apartments in London’s Shard are owned by rich foreigners (Russians, Middle Easterners, other kleptocrats) looking to avoid taxes / seizure during corruption trials or revolution. The rich leaving is a political problem. Does the US let them renounce US citizenship, take their money, and still visit and invest in US companies? This is a political choice for US voters to make. But most of the rich won’t leave the US, most won’t even leave the state they are established in for a state with lower taxes.

One last dishonest bit of Bilyeu–he says that the US government pulled in less in federal tax during the 1950s when the top rate was 90% than it does today, to prove his poiint that a high tax rate on the wealthy can’t bring in income. Of course, the US is about four times richer today and has an economy nine times as big with double the population, so not a good comparison!

Tariffs

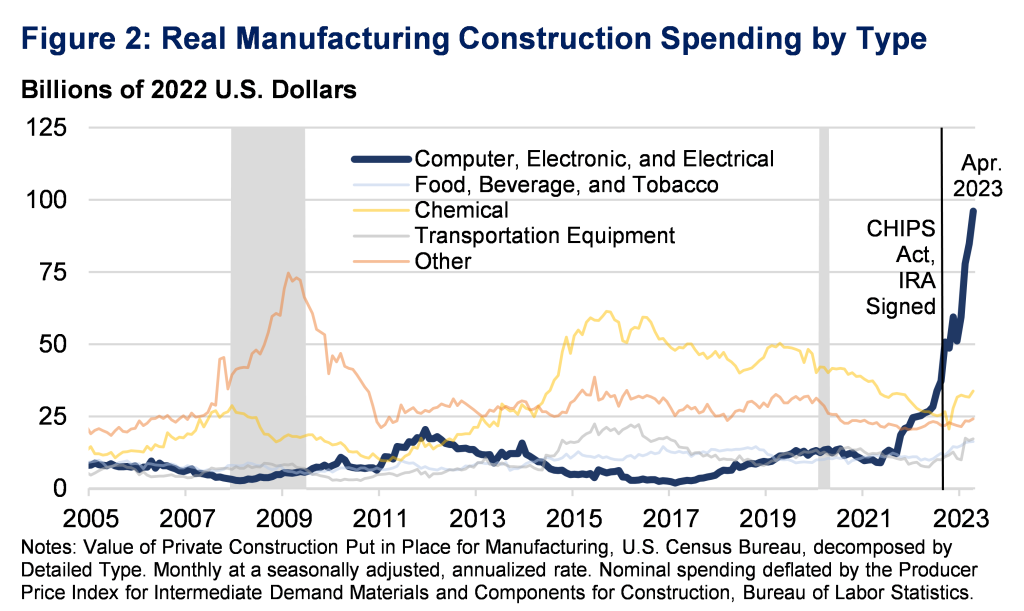

In another recent episode, He says Trump’s high tariff policy, and chaos tariff policy, will ‘bring manufacturing back to the US’. Trump’s tariff policies have have had little effect on US manufacturing, and are not expected to have a big impact. The primary effects on the US are increased inflation, lower exports leading to higher unemployment and lower GDP growth. The 2026 Republican budget cut and canceled a big chunk of the 2021 Infrastructure Investment and Jobs Act, which did raise manufacturing investment in the US.

The effects of tariffs is well understood, conventional economics. A sustained and well implemented policy of higher US tariffs would decrease imports and increase manufacturing in the US. This would be offset by decreased exports. Overall, US economic growth would slow, and slow relative to other developed countries with lower tariffs and higher trade.

Other notes

Bilyeu says ‘everyone’ can buy into the stock market and gain along with businesses. In fact, 2/3 of households in the US don’t have substantial investments (have < $26k). The majority of US workers don’t have excess money to invest.

He thinks AI is the next big thing, and is the solution to most knowledge and business problems. Bilyeu thinks Elon Musk’s predicts about Artificial General Intelligence (human-like AI) are worth considering. Musk has been saying self-driving Teslas are right around the corner for the last decade (link). No informed person thinks the current type of AI will develop into human-like AI. It’s like predicting a tadpole will turn into a flashlight.